Healthcare Platform Businesses and the new DTE marketplaces

This article discusses four current healthcare platform business categories (EHRs, BUCAs, clearing houses, & PBMs) and a new emerging healthcare platform business (Direct to Employer (DTE) contracting). Creating a new platform business is difficult in any sector, but it is near impossible in healthcare because healthcare incumbents resist change.

Before we dive into healthcare platform businesses though, I want to give a little background on platform businesses in other sectors.

Background on Platform Businesses

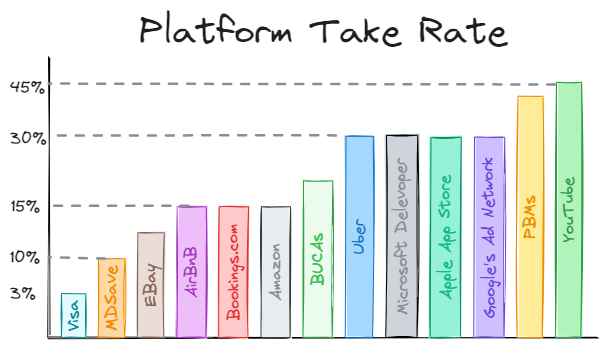

Platform businesses provide digital tools to connect producers with consumers (infrastructure), help consumers find the best match (curation), and allow both sides to exchange value (transactions). The platform can facilitate the trade of goods (Amazon/Robinhood), services (Uber), or user attention (Facebook/YouTube). A platform business that sells goods and/or services is often called a marketplace or aggregation platform. A platform that sells user attention is usually called a social network. Platform businesses provide the tools, protocols, and/or governance to remove friction and enable trust between the two transacting parties. In exchange for providing this infrastructure, platforms are allowed to extract a fee on the transactions called a take rate.

A platform business is often a digital middle man that does not own the means of production of the goods and/or services but rather creates value by uniquely connecting supply and demand with trusted digital infrastructure. In contrast to a platform business, a traditional linear business creates value by using its raw materials and people as inputs to produce goods and services. A linear business can lower the price of their products until the customer perceives value and transacts. A platform business must provide value to both the customer and producer to facilitate an exchange. A platform business must purpose mutually agreeable terms for both parties to participate or subsidize one side of the marketplace. Platform businesses are twice as hard to start (chicken and egg problem) as a linear business, but when both producers and consumers are willing to transact on the platform, the platform businesses can grow faster (network effects) with better margins, and are harder to disrupt (scale) than linear businesses. Obviously, the most prominent businesses today (Mag 7 stocks) are platform business, so everyone wants to create the next big platform business.

Healthcare examples of Platform Businesses

Most businesses in healthcare are a traditional linear business. For instance, physicians groups delivering healthcare services is a traditional linear business because the physician group controls the people that are delivering the service/care to patients.

Many healthcare businesses have great network effects, but that does not mean they are platform businesses. To be a platform business, they must generate revenue by allowing other third-party businesses access to their network effects.

Electronic Health Records (EHR)

EHRs (Epic, Cerner, and Athena) are digital healthcare platform businesses. They created a proprietary patient health record that is valuable to many parties. They allow dictation software companies, revenue cycle management companies, and care coordination companies access to the EHR’s customers (physician groups and hospitals). Some EHRs have app stores that are similar to Apple’s or Salesforce’s app stores. Epic has the showroom, and Athena has a marketplace. These EHR’s charge the third-party companies administrative fees and a percentage of their revenue which many of these companies complain about.

Health insurance networks

Healthcare insurance networks like Blue Cross, United, Cigna, and Aetna (BUCAs) connect plan sponsors (i.e. employers) with providers using trusted protocols and governance (claims adjudication, utilization management, etc.).

A insurance network (BUCA) contracts with physicians and hospitals (supply side) to provide their healthcare services at a contracted rate. The BUCAs must sell their network to employee benefits consultants (EBC), plan sponsors, and/or employers (demand-side). These BUCAs provide digital tools for claims adjudication, utilization management, and payment dispute resolution. In short, the BUCAs try to ensure trust between all parties and facilitate appropriate transactions with minimal friction.

BUCAs have great network effects, but also allow third-party point solutions to sell to the BUCA’s plan sponsors and utilize the BUCAs infrastructure. For example, a digital diabetes solution company or mental health app might sell their services through an arrangement with a BUCA and access claims data to reach qualified patients (enrollment marketing). In addition, BUCAs contract with other companies like Waystar and Experian to provide prior authorization services.

Clearing Houses

Change Healthcare, Availity, Waystar, Navinet, and Relay Health connect physician groups to the insurance networks (BUCAs payers). The clearing houses standardize the “payment rails” that allow physicians to get paid for the services they provide. The clearing house makes sure the patient information provide by the physician group is properly entered, coded, and sent to the appropriate payer. Change Healthcare, owned by United Healthcare, processes 15 billion transactions a year.

For an entertaining read about the cyber security hack of Change Healthcare, please check out the out of pocket article by Nikhil Krishnan.

Clearing houses work with other third party businesses to monetize their de-identified “data exhaust.”

Pharmacy Benefit Managers

Of all the tangled webs in healthcare, PBMs have created the most confusing structure to obfuscate the ways that they take advantage of their customers.

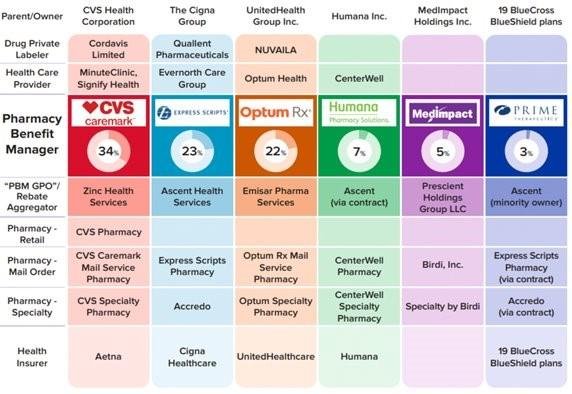

Express scripts, Caremark and Optum Rx process about 80% of all prescription claims or 5.3 billion prescriptions. They set prescription prices paid by the patient and/or plan sponsor. They set reimbursement rate for pharmacies. The difference between what the plan sponsor pays and what the pharmacy gets is called spread pricing and is how some PBMs make money off generic medications.

PBMs make money through spread pricing, administrative fees, utilization management fees, data management fees, skimming rebates through rebate aggregators, charging pharmaceutical companies to include their medications on their formularies, mail order pharmacies, and directly charging plans a per member per month fee to access their contracts.

Plan sponsors have a fiduciary responsibility to their employees to not allow their PBM to steal from the plan and/or employees. Plan sponsors must audit their prescription claims to ensure that the PBM is not taking advantage of the employees (see J&J lawsuit).

Some experts have claimed that PBMs slim around 20-30% from plan sponsors and employees. I personally reviewed my organization de-identified paid claims for our top ten generic medications for the first half of 2024. I compared these paid claims to publicly available rates on GoodRx and Amazon. My organization and our employees would have saved 75% of that amount paid if they purchased their generic medications through GoodRx or Amazon. That means our old PBM marked up these top ten generics medications 4x to the tune of about $75,000. In addition, about 50% of our prescription spend went through our PBMs mail order pharmacy for specialty medications which means our employees did not get put on generic Humira and other bio-similars. Everyone must audit their prescription claims.

Express Scripts' group purchasing organization (GPO) is Ascent Health Services, which was established in Switzerland in 2019. CVS Caremark's group purchasing organization (GPO) is called Zinc Health Services. Emisar Pharma Services, created by OptumRx in 2021, is another GPO based in Ireland. These GPOs are also known as rebate aggregators. Why would an American company doing business on American patients in America start a GPO in Switzerland and Ireland? Why would these PBMs not use their GPOs for their government insurance programs. If you defraud the federal government, you go to jail. If you defraud a plan sponsor or patient, you get rich. The chart below is from the FTC’s recent PBM report.

PBMs have great network effects. As shown in the chart above, they tend to own most of the “third-party” businesses that are allowed to access their network effects, so their status as a platform business is weak. I included PBMs in this platform discussion because it is an interesting discussion on when businesses with network effects allow third party businesses on their platform vs. vertically integrating and owning the entire supply chain.

Direct to employer (DTE) contracting

Direct to employer contracting is in its infancy (<1% of all commercial claims) despite receiving lots of PR from Mark Cuban. DTE is a highly fragmented market but makes for an interesting discussion on how these entities are positioning themselves to become the next healthcare platform company.

The BUCAs realize that these DTE contracts weaken their networks. Many large hospitals require the BUCAs to give them “most favored nation” status in their contracts that obligates the BUCAs to not steer patients away from the large hospital (see Stacey Richter and Cora Upsahl’s discussion on this issue in this Relentless Health Value podcast). DTE contracting often steer patients to lower cost providers who are not associated with these large hospitals, so the BUCAs have to decide if they want to upset their large hospital partners or their plan sponsors. To date, the BUCAs have usually catered to the large hospitals, but when a Fortune 500 company (like Walmart) with 100’s of thousand covered lives demands DTE contracting, some BUCAs will agree to the Fortune 500 company’s terms. As a result, most of the businesses who are doing DTE contracting are either Fortune 500 companies (Walmart’s COE) or medium sized companies who are willing to use a non-BUCA for their wrapper network. The BUCA networks are trying to offer their own commercial surgical bundles as an alternative to DTE contracting.

The diagram above shows the demand side (employers) on the left and the supply side (physicians) on the right. The entities in the middle are the players who are trying to offer an alternative to a BUCAs and provide the necessary infrastructure, curation, and transactional rails to create a DTE marketplace.

Lantern is probably the largest player in the DTE space with between ~6-7 million covered lives and works mostly with the Fortune 500 companies. Lantern is a rebranding of Employee Direct Healthcare and Surgery Plus. Surgery Plus has the most liquidity in the surgical bundle space.

Transcarent is probably the second biggest player in the DTE space after acquiring Accolade last month (Jan. ‘25) to improve their care navigation. Transcarent has around ~4-5 million covered lives.

Lantern and Transcarent enter into a shared savings contract with Fortune 500 companies to decrease their healthcare spend on MSK, oncology, direct primary care, and cardiology. They design tiered health plans for the 100’s of thousands of employees with both proprietary and third-party solutions (i.e. the companies in the middle of the diagram above).

DTE marketplaces like MDSave and Coral may work directly with a smaller plan sponsor or partner with a demand aggregator like Contigo to provide DTE contracting. Smaller plan sponsors may utilize their employee benefit consult to piece together some of these companies in the middle to create their tiered networks and incentivize their employees to get receive high-valued care.

Any successful DTE plan design requires: a DTE market, care navigation, quality data, and often some point solutions. The DTE market provides bundle pricing and payment rails. The care navigation often steers patients to surgical avoidance and less costly virtual treatments. When care acuity needs to be elevated, the care navigation ensures that the patient is sent to the highest quality and lowest cost physicians using the quality data. Most DTE plan designs try to solve for orthopedics, oncology and direct primary care and then use a wrapper network to cover the smaller unexpected healthcare claims.

The demand aggregator’s shared savings plans will likely easily hit their targets in the beginning as low hanging fruit is picked like changing the site of service from hospitals to ASCs (honeymoon phase). In five to ten years, demand aggregators will struggle to further lower the cost of care as finding additional savings gets harder. These struggles will inevitability lead to more avoidance of surgery and expense test and pricing pressure on physicians to lower their bundle prices. These DTE companies will also likely consolidate over the next 5-10 years as the large entities bring everything in house through acquisitions. These larger companies will create larger network effects which will put more pricing pressure on physicians groups.

The Platform Test

How can you tell if your healthcare company could be a platform business? How “platformizable” is your company? Let’s start with an assumption that your new company can build your technology stack. Technology is no longer the barrier to becoming a platform company. Relationships and trust are the critical requirements to get liquidity in your marketplace.

If your company released a software developer kit (SDK), what other healthcare companies would use your SDK to build on top of your technology stack? How would those other companies generate revenue selling their products and services to other entities on your platform? This question points to the scale needed to become a platform company. If your company has a small market share or is geographically constrained, then others businesses will not use your SDK to build on your platform. Microsoft struggled to find developers in 2010 who would build on Microsoft’s mobile OS when Apple’s app store dominated the mobile market. Once a big company gets network effects, it is hard for another company to entice both sides of a market place over to their marketplace.

This platform test points to the importance of network effects. A new company that is trying to build a platform business must first achieve strong network effects before they can become a platform business. In other words, a new company must have network effects before they can rent out their network effects to other third-party companies. Non-strategic companies will incorrectly think they can build everything, where as strategic companies in new markets will partner with third party companies to increase their speed to market and grow their network effects.

Let’s apply this platform test to the DTE market. IMHO, Lantern or Transcarent will probably initially partner with most of the smaller players in the middle to increase their product offerings and network effects. Lantern and Transcarent will have the relationship with the demand side (plan sponsors) which they can utilize to pressure the middle companies. Once Lantern have sufficient network effects, they will be able to acquire the companies in the middle that they want and exclude the other ones.

Additional reading and podcast material on platform business strategy.

Acquired Podcast

NFx Podcast

Book - Modern Monopolies

Book - 7 powers, by Hamilton Helmer

Online Article - Jeremy Schwartz (Wisdom Tree)

If you enjoyed this article, please check out some of my other articles.

A business case for physician extenders in an orthopedic practice

Class Action Lawsuits against Medical Providers for data breaches

How digital health could disrupt orthopedic provider

DMSK Providers vs. MSK Digital Health

Direct to employer contracting.

Transitioning from Scarcity to Abundance in Orthopedics

Why orthopedic implant companies struggle with developing patient engagement software